2017 was another milestone year in Cementir’s history, as the Group built on the strategy of focusing on its international presence and long-term growth.

A number of initiatives

that helped to change the face of the Group

have been brought to a close.

Some of the most important steps in this process, which began towards the end of last year, included: the acquisition in Belgium of the CCB Group (Compagnie des Ciments Belges), finalised in October 2016, the sale of the Italian operations announced in the fourth quarter of 2017 and, in February 2018, the agreement to acquire Lehigh White Cement Company in the United States.

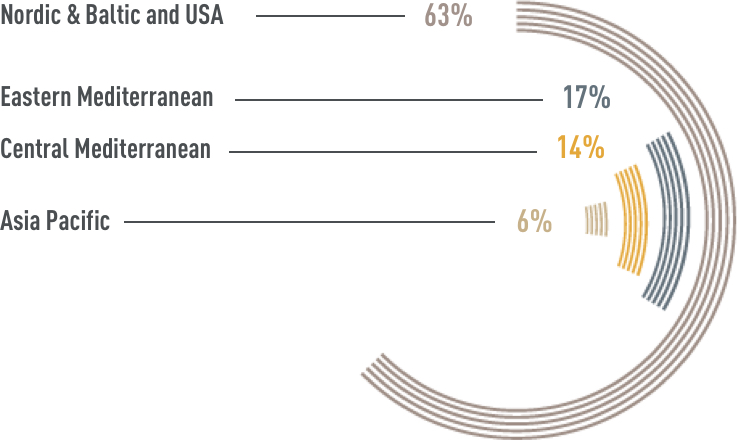

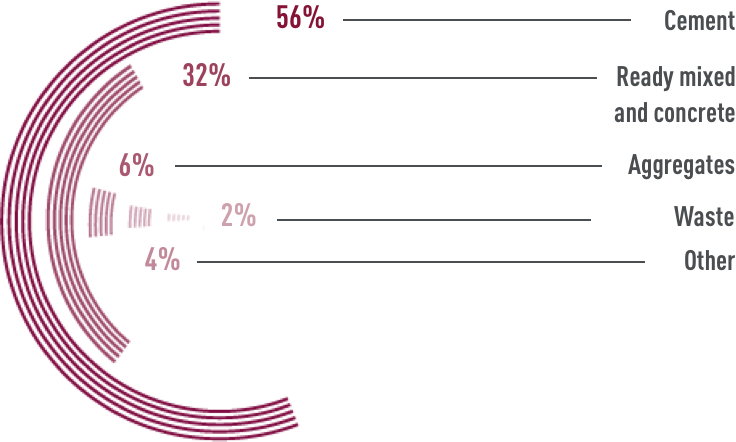

These three deals have radically altered the Group, whose revenue now comes exclusively from outside Italy. Through the CCB Group, we have diversified into the grey cement sector in Belgium, shifting the focal point of our geographical presence from the Mediterranean to Central Europe, strengthening our portfolio with a significant position in both the aggregates and ready-mixed concrete business in Benelux and France.

Mergers and acquisitions will remain at the heart of the Group’s future strategy, which will be carried out with the usual financial rigour and uncompromising focus on return on investment.

Last year closed with EBITDA of EUR 222.7 million, up on the preceding year’s EUR 197.8 million. This was driven by the 12-month consolidation of the CCB group and the uptick in business in China, United Kingdom, Norway and Sweden, substantially offsetting the deterioration in results in Turkey, Egypt and Malaysia, and the negative impact of the fall in the value of the Turkish lira and the Egyptian pound.

Group net profit was also up 6% to EUR 71.5 million from EUR 67.3 million in 2016. On the financial front, return on investment and ROE both improved and net financial debt fell.

As shown by the agreement to acquire a majority stake in Lehigh White Cement Co. in the United States, developing our leadership in white cement is at the heart of our international strategy. The aim is to cultivate global recognition of the role and quality of Cementir products, with a focus on product innovation and new applications.

There is still untapped potential for white-cement products. Now, thanks to the know-how we have acquired over the years, we intend to expand our customer offering still further, with a view to consolidating our market positioning.

To this end, we have created a global driver of innovation for white cement called InWhite. The aim is to come up with a series of high added-value initiatives for customers, so that we can offer new solutions for traditional applications as well as absolutely innovative applications.

This is a complex challenge and we will only succeed if we present ourselves to the market as one cohesive and fully integrated group, with even the recently acquired companies working towards a shared objective and presenting a consistent Cementir brand to the world. To succeed, we must instil a new Group culture that reflects everyone who works at Cementir.

Shared values, a shared vision, a single mission and a standardised leadership model for people to follow in their professional development are the keys to this integration process, which is essential for the growth of the Group.

The message that we have chosen to inspire our organisation and guide our people in the years to come is Concretely Dynamic. That means that we must be concrete and determined in pursuing our goals, while also being dynamic, flexible and ready to seize the best opportunities.

We therefore aim to grow, yet without neglecting respect for sustainable development that starts within our own business – for example in waste management – and also includes respect for the environment, personal development and engagement with the communities affected by our industrial activities.

We also want sustainability to be a driving force in developing an innovative way of doing our work. We must be ready to confront the new challenges that the international approach to climate change and sustainable development pose for our industry, while also seeing sustainability more and more as a key factor in our strategy and future actions.

Sure in the knowledge that we all share this aim, I would like to thank our shareholders, employees and everyone who worked with us in 2017 to help achieve these results, which today make us proud to be part of the Cementir Group.

Francesco Caltagirone Jr.

Chairman and CEO